How can you use currency strength?

Our currency strength meter shows the relative currency strenght between the 8 major currencies. On addition our calculation method shows the direction of the change (pointed with arrow close to the name of the currency). We calculate the relative strength by comparing the movements in all the crosses between the majors.

Is the currency strength information useful?

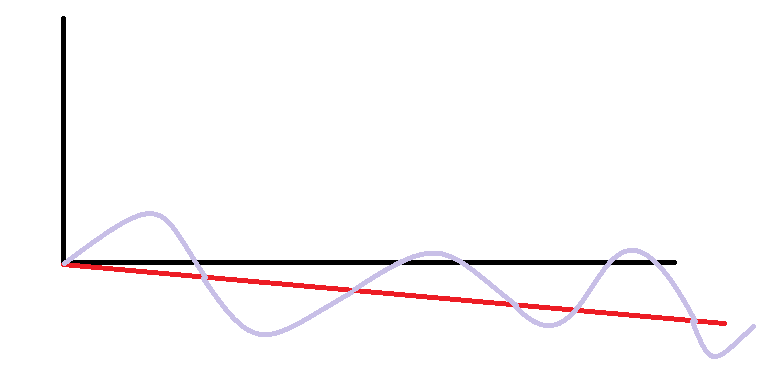

To test this, we will use one simple example. We will take a simple trading strategy that buys when it is 17:00 GMT and we have no other opened trades. This will execute one trade at the open of the bar. Then we will close these trades via stop loss and take profit which is evenly placed at 50 points from the open price. This should give us a 50:50 chance, so the strategy result must oscillate a line with a slight downward angle. The strategy will slowly lose because we have spread and the losses are slightly bigger than the profits.

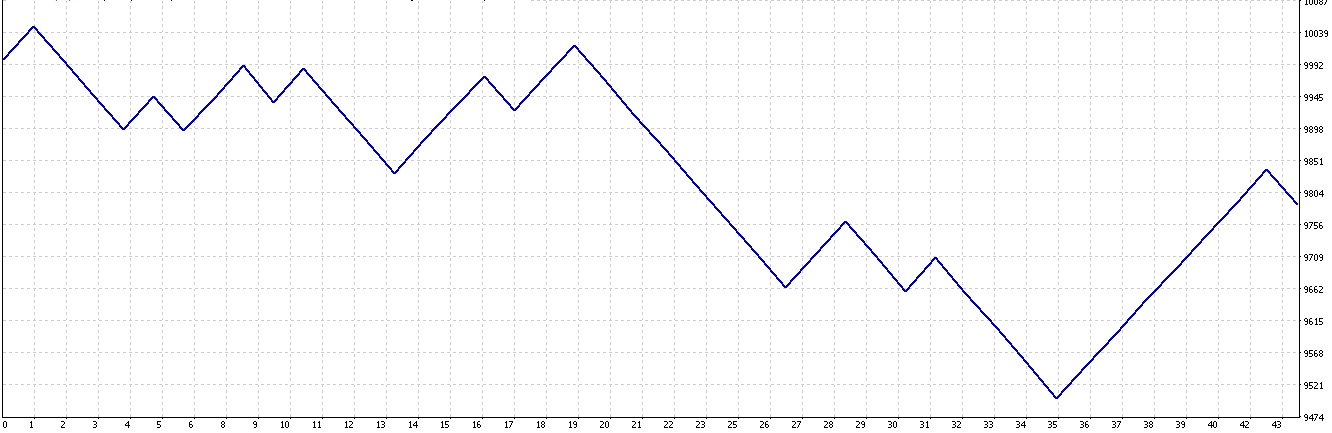

So the result is just as expected. We have wins we have losses , but in the end we are going down because of the transaction costs.

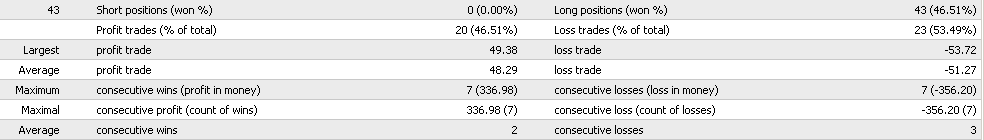

According to the stats we have 46.51% winning trades and 53.49 losing trades which is very close to the expected 50: 50. Also, the maximum consecutive losses and maximum consecutive wins is a similar number - 7. The number of trades is not so much - only 43, which is not so statistically significant, but we are doing just a simple example.

Now the question is what will happen if we put the currency strength in our simple strategy. There are many ways to do that - we can monitor how the strength is changing, or how strong is one symbol compared to the other, or wait for a moment when EUR will be the strongest instrument and USD the weakest. Instead, we will do something very simple - we will just add a filter by which we will open buy only when EUR is stronger than USD. We will ignore what is their position according to the other symbols.

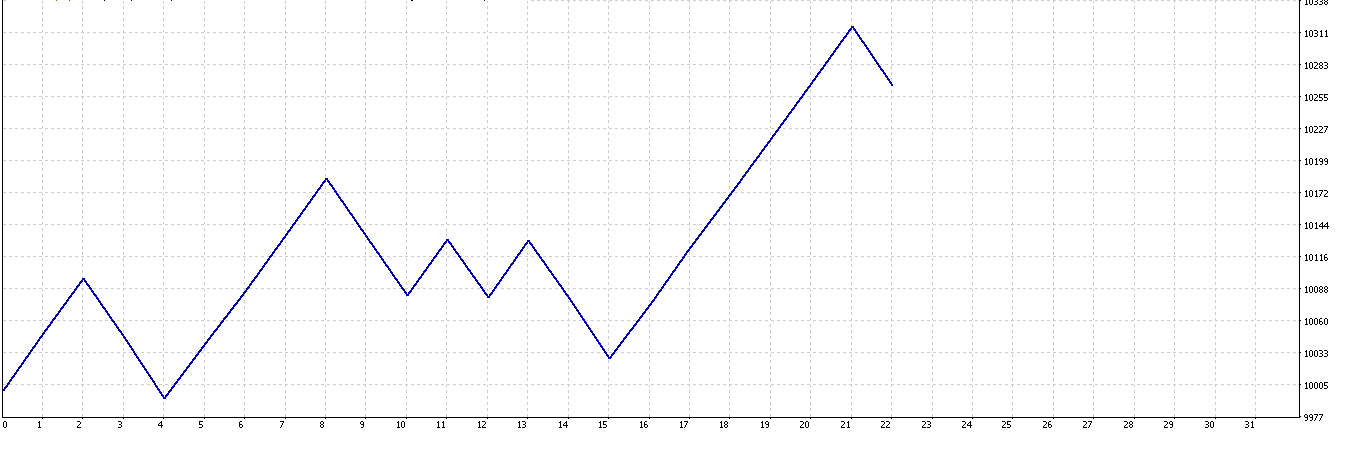

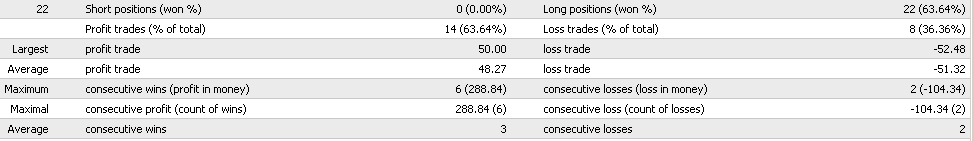

So the backtest on the same data returns this result:

Now we moved from losing to winning. The winning trades become from 46.51 to 63.64%. Of course, this is not scientific research, the statistics are not huge, but it is enough to prove our point- that including the currency strength in the trading can improve even random strategy.

Is currency strength enough for a good trading?

The currency strength by itself is not enough for developing a good trading strategy, but it can be a great addition to all(or almost all). So when you are making your own trading rules, it is always a good idea to check how adding the currency strength will affect them, and if this is in a positive way, you must use it. There are so many ways to use it - you can take the strongest, weakest, choose the trading symbol depending on the strength, or trade-specific symbol only when there is a specific change in the strengths.